Financial institutions, payment processors, and banks today find themselves in a rather unique position. They are now embracing Bitcoin and other cryptocurrencies and advocating for their use, one that was built from the ground up to eliminate middlemen and third parties from a transaction. But are these financial institutions and banks truly passing on the advantages and cost benefits of crypto to their customers and merchants? Or is there more to their sleight-of-hand offerings?

Why Bitcoin Matters in a Centralized World

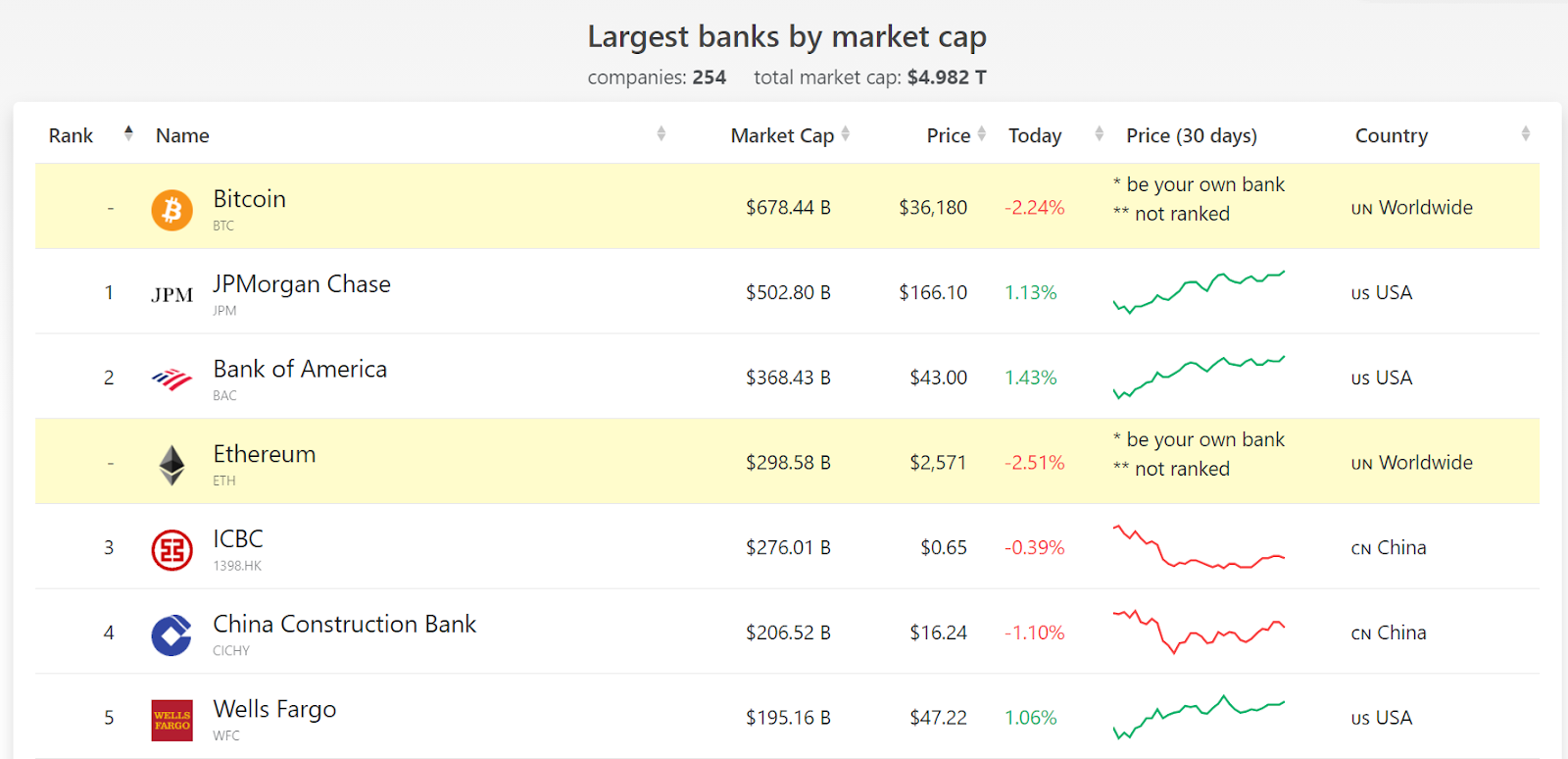

Bitcoin began as an idea in 2008 to revolutionize transactions – by directly connecting one party to another without going through middlemen or a centralized financial institution, an idea that was as incredible as it was outlandish at that time. Yet, today we see Bitcoin standing at the top with a total valuation of $650 billion+; a figure that is higher than the market capitalization of JPMorgan Chase, Bank of America, Wells Fargo, or any of the top 10 financial institutions globally.

Bitcoin tops the list and is well ahead of banks by market cap.

Initially, Bitcoin was scoffed at and was declared as a novelty by financial institutions who looked at it as a non-competitive entity. The realization that a decentralized computer-coded virtual currency could ever threaten their existence never dawned on them. So while banks and payment providers gradually went around their business and scaled their empires onto the e-commerce and virtual payment sectors, customers and merchants found themselves weighed down by the same heavy transaction fees that they knew very well from before. Despite online e-commerce being more of an automated process than any other payment system, credit card companies neatly took their 2-5% fees while leaving merchants and shoppers vulnerable to frauds and chargebacks. In the case of merchants, the slow transaction speed and the multiple forms that had to be filled by shoppers often discouraged buyers from carrying out multiple purchases – even if the devil known as card declines was not present.

With so many issues weighing down the global e-commerce and payment industry, Bitcoin’s arrival brought in fresh steam to an extremely stagnant industry that needed innovative new ways to get around problems. Not only was Bitcoin’s decentralized blockchain system much more secure and fraud-proof, but all it ever took for a transaction: was three simple and straightforward steps.

- The Input: Public Bitcoin address of the origin wallet

- The Amount: Amount of bitcoins to be sent on the transaction

- The Output: Public Bitcoin address of the destination wallet

By cutting down the middlemen and simplifying the entire transaction model, Bitcoin managed to cut down many of the existing problems at its time. The simplified process meant that the transaction fees charged were far less, it was more secure and transparent due to the blockchain system that powered it and any and all transactions could occur without any geographical limitations! Bitcoin allowed global trade and people, perhaps for the first time, finally gained the autonomy to conduct transactions outside a centralized and restricted financial environment. That was the founding vision of the anonymous Satoshi Nakamoto, the creator of Bitcoin. With already five months of 2021 behind us, we can perhaps look back at the years gone and marvel at how the very financial institutions who once mocked Bitcoin are now stepping up to profit from its growth. But the question remains – just how can a centralized financial institution offer decentralized solutions to its customers?

Why Merchants Are Still Missing Out on Benefits

The interest in tapping into the increasingly valuable crypto trade started early for companies like PayPal, which realized the growing importance of Bitcoin back in 2014.

As Bitcoin has become increasingly attractive due to the large gain in its market capitalization and value, financial industry players rushed to get involved with a new system that they believed they could make money from. Recently, Gemini and MasterCard announced that they would be launching a new crypto rewards credit card sometime in the summer of 2021, stating that they would reward shoppers up to 3% back on qualifying purchases, 30 cryptocurrencies that could be used to transact, and no annual fee for the card. While this looked good for mainstream crypto adoption on paper, the exact process behind these transactions has not been spoken about at the time of publication. The fact that a wide majority of these “crypto credit cards” use a fiat-crypto-fiat conversion model often makes them highly inconvenient and ends up increasing the transaction fees for merchants, who ideally should be charged around 1% for every crypto transaction, instead of the industry defined 2-5% that is levied on every credit card transaction. It becomes clear then that behind the apparent adoption of crypto, financial institutions are still charging the same exorbitant fees to merchants while using the decades-old credit card infrastructure. What could have been an incredible innovative method to fuel global payments fizzles out as a marketing tactic to draw in newer customers.

Why Crypto Reward Cards Will Do More Harm Than Good

BlockFi, the cryptocurrency lender, was amongst the first financial institutions to offer the idea of a crypto reward card in the market in December 2020. The premise was quite simple after all. Take a good old credit card, throw the logo of a cryptocurrency exchange on it and market it as a unique offering that gives crypto cashback to its customers. Downsides? It was a good old credit card with zero technological upgrades (read: no blockchain technology powering it) and the same high fees for merchants. But there happen to be bigger issues in place that could spell considerable problems for its customers.

Crypto reward credit cards have zero technological upgrades and charge the same high fees for merchants.

Not only are crypto reward cards difficult to obtain in the U.S due to limited availability, but there is considerably less information available online that talks about its fee structure. If a customer purchases crypto using fiat from an exchange, they are likely to pay a transaction fee to the exchange. Since the cashback will be integrated via an exchange and into the customer’s wallet, the fee will most likely reduce the credit card reward earned. This effectively makes the crypto reward card just another marketing tool that actually benefits the cryptocurrency exchanges more than tie-up with the companies offering it by generating another revenue stream.

Another fact the companies are not addressing is the matter of tax filings. We had already addressed the problems with crypto taxation in our previous article, where we had pointed out the difficulty of filing taxes that served as a hindrance to its mainstream adoption to the majority of crypto users. With the introduction of the novel crypto reward cards, organizations like Mastercard and Visa are not issuing the necessary features that should accompany such a system. RocketFuel has already addressed and solved this issue by guaranteeing the deliverance of fully completed Form 8949 to all its existing and new shoppers; a task that simplifies crypto taxations to the IRS and prevents shoppers from having headaches over trying to remember which crypto they had used to pay for a cup of coffee months ago.

Features like this not only inform the customer base of the potential problems they might face, but they also help provide solutions to foster the growth of the crypto industry – a feature that most mainstream centralized financial companies seem to neglect. By hyping up old products in the guise of crypto adoption, they are glossing over the solutions that need to be integrated for mainstream crypto acceptance and are risking the image of cryptocurrencies to their customers, who may not be well informed about what they are getting into while also losing out rewards due to a complex fee structure.

RocketFuel’s Vision of a Crypto-Integrated World

In order to achieve a truly digital payment future, we must not be afraid to innovate and create industry-defining solutions that transform our concepts of how e-commerce works. To facilitate and empower online contactless transactions, we need to ensure that the benefits of the system are passed on to merchants and shoppers. The unique nature of cryptocurrencies enables RocketFuel to provide merchants with the lowest transaction fees in the industry along with daily funding, a super-fast checkout process, and zero chance of fraud and chargebacks. Shoppers also benefit from our model because of lower-priced services, high security, and increased privacy (we never ask for any personally identifiable information). With our recent offerings of free Form 8949 filings, it is our endeavor to support a movement that aims to liberalize e-commerce worldwide by allowing borderless transactions to occur fast and with the utmost transparency.

With world governments gradually warming up to the idea of cryptocurrency transactions, and the recent statements made by NYDIG that hint at a possible inclusion of American banks in Bitcoin trading, the door to the future is clear. Cryptocurrencies are here to stay, and though regulations might change the way it was originally conceived to be, their unique blockchain-powered model will bring considerable benefits to merchants and shoppers as well as transform the payments model we have so grudgingly grown used to.

Book a demo to learn more about RocketFuel and how we are innovating blockchain payments.