Any transaction in which the payer and payee are in separate nations is a cross-border payment. These transactions can occur between people, companies, and financial organizations. In 2022, global cross-border payment flows exceeded $156 trillion USD, making it one of the fastest expanding parts of the global payments ecosystem.

With the introduction of crypto, the dynamics of cross-border payments have been evolving. Let’s see how cross-border payments have been changing with Bitcoin and other cryptocurrencies.

Examples of Cross-Border Payments

There are numerous different types of cross-border payments, including (but not limited to):

- Bank transfers

- International wire transfers

- Electronic funds transfers

- Credit card payments

- Debit card payments

- Prepaid debit card payments

- Global ACH payments

- Digital currencies

- Buy now, pay later

- Blockchain-based payments

- Voucher-based payments

- Cash-based payments

- Paper checks

The Role of Crypto in Cross Border Payments

The blockchain does not sacrifice immutability. A decentralized network takes the role of centralized authority in this scenario. A network of nodes validates the monetary transaction.

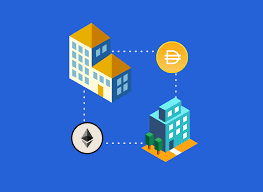

A basic peer-to-peer transaction becomes more complicated, much like traditional cross-border payments, due to diversions through bank branches. Because there are fewer negotiators, the transaction is completed in real-time on the blockchain network. Money may be transferred anywhere in the globe using several public blockchains worldwide.

The transaction typically takes a few days to complete; however, there are occasions when it fails and there are mistakes in the transaction. Blockchain, on the other hand, encourages openness and traceability. Many various industries’ pain problems are addressed through the network. All transactions are conducted fast and for a little cost.

The blockchain is now being used to pilot transactions by even major financial companies. The top layer technology stays the same, while a little change in the core allows it to function on a blockchain.

There will be two sorts of blockchain networks in the future: centralized and decentralized. Alternatively, blockchain companies might replace all current currencies with cryptocurrency.

Stablecoins will also be included in the transaction process if the latter happens. Stablecoins will grow in popularity since they are useful in balancing volatility.

Furthermore, government entities are progressively implementing blockchain technology to manage financial settlements, improve current legal frameworks, and grant disbursements.

At RocketFuel, we ensure that companies with subsidiaries in multiple countries can send funds by paying a minimum fee. Company A sends the funds in crypto to Company B and this one receives the funds in fiat: dollars, euros or any other local currency. There are incredible differences between the fees that a merchant has to pay to send a crypto transfer as opposed to what it needs to pay to credit card companies.

For for information, call us today.