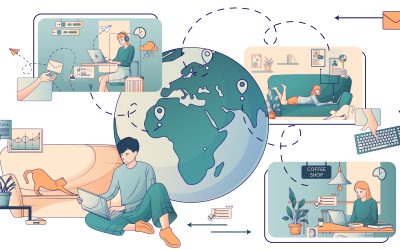

In today’s increasingly interconnected world, businesses with offices and operations spread across multiple countries often face significant challenges when it comes to managing cross-border payments. Traditional banking systems can be slow, expensive, and cumbersome, posing obstacles to efficient financial management. However, the advent of cryptocurrencies has opened up new possibilities for B2B cross-border payments, offering a more streamlined and cost-effective solution for global businesses. In this blog post, we will explore how B2B cross-border crypto payments can revolutionize the way businesses manage their international transactions.

Overcoming the Limitations of Traditional Banking Systems

Traditional cross-border B2B payments typically involve multiple intermediaries, such as correspondent banks, which can lead to high fees, unfavorable exchange rates, and delays in processing. These inefficiencies can have a significant impact on businesses’ cash flow, operational costs, and overall competitiveness.

In contrast, cryptocurrencies operate on decentralized networks, allowing for direct peer-to-peer transactions without the need for intermediaries. This can result in lower transaction fees, faster processing times, and better exchange rates, making cryptocurrencies an attractive alternative to traditional payment methods for international B2B transactions.

Seamless and Efficient Cross-Border Payments

One of the key benefits of B2B cross-border crypto payments is the seamless nature of transactions. Businesses can easily send and receive payments in various cryptocurrencies, such as Bitcoin, Ethereum, or stablecoins, without having to deal with multiple currencies or navigate complex banking procedures.

Crypto payments are processed much faster than traditional bank transfers, often taking just minutes or hours rather than days. This can greatly improve businesses’ cash flow management and allow them to respond more quickly to changing market conditions.

Furthermore, cryptocurrencies can facilitate micropayments and fractional payments, enabling businesses to pay for goods and services with greater precision and reducing the risk of overpayment or underpayment.

Enhanced Security and Transparency

Cryptocurrencies provide a high level of security and transparency for B2B cross-border transactions. Transactions are secured by advanced cryptographic techniques, ensuring that they are authentic and tamper-proof. Additionally, all transactions are recorded on a public ledger, providing an easily accessible and transparent record of all payments.

This enhanced security can help protect businesses from fraud and unauthorized transactions while also simplifying the process of tracking and reconciling payments. Moreover, the transparent nature of crypto transactions can facilitate compliance with regulatory requirements and help businesses demonstrate their adherence to anti-money laundering (AML) and counter-terrorist financing (CTF) rules.

Financial Inclusion and Access to New Markets

By adopting B2B cross-border crypto payments, businesses can tap into new markets and work with partners in countries with limited access to traditional banking services. Cryptocurrencies can serve as a bridge between different financial systems, enabling businesses to reach previously untapped markets and collaborate with partners worldwide.

This can lead to new opportunities for growth and expansion, allowing businesses to stay ahead of the competition and capitalize on emerging trends in the global economy.

Preparing for the Future of B2B Payments

As cryptocurrencies continue to gain mainstream adoption and regulatory frameworks evolve, it is crucial for businesses to stay informed about the latest developments in this space. By embracing B2B cross-border crypto payments, businesses can position themselves at the forefront of the digital payments revolution and reap the benefits of lower costs, faster transactions, and greater financial flexibility.

It’s essential for businesses to choose the right cryptocurrency payment solution that meets their specific needs and offers the desired level of security, functionality, and ease of use. By doing so, they can streamline their international payment processes, reduce operational costs, and unlock new opportunities for growth and collaboration in the global marketplace.

RocketFuel’s B2B cross-border payments stand out as a game-changing solution for businesses with a global presence. By harnessing the power of cryptocurrencies, RocketFuel enables seamless, secure, and cost-effective international transactions, overcoming the limitations and inefficiencies of traditional banking systems. Its user-friendly platform simplifies the payment process, allowing businesses to manage their global financial operations with ease. With faster transaction times, lower fees, and enhanced security, RocketFuel’s B2B cross-border payments provide an unparalleled level of convenience and flexibility, empowering businesses to thrive in an increasingly interconnected world.

Conclusion: Embracing the Potential of B2B Cross-Border Crypto Payments

B2B cross-border crypto payments offer a myriad of benefits for businesses with offices and operations around the world. By leveraging the power of cryptocurrencies, businesses can overcome the limitations of traditional banking systems, streamline their financial management, and tap into new markets and opportunities.

As the world becomes increasingly digital and interconnected, B2B cross-border crypto payments have the potential to transform the way businesses conduct international transactions and shape the future of global commerce. By embracing this technology, businesses can position themselves at the cutting edge of innovation and ensure their continued success in an ever-changing global economy.